The Future of Insurance, Banking, FinTech and Payments – May 2022

Insuring autonomy

How collaborative mobile robots accentuate the need for new liability models

The stellar growth of e-commerce in the past two years has also accelerated technological progress in warehouses and fulfilment centres. Footages of gliding discs performing angular dance routines with towering shelves mounted on them have been impressive enough. But as the checked patterns of magnetic strips and wires on the floor give away, their autonomy is just an illusion.

More recently, it’s autonomous mobile robots (AMRs) that are stealing the show. They are easier to deploy and tailor to seasonal changes in demand, as they’re not guided by meshes embedded in the floor but by maps stored in their software. They are capable of planning multiple routes, picking the optimal one and pivoting to another if they see an obstacle blocking their way.

Although there seem to be lights-out warehouses and hazardous environments at the end of the road where AMRs will keep completely to themselves, today they are overwhelmingly cobots that need to work with their human peers.

Not unlike self-driving cars, AMRs have the long-term potential to make their environments safer as a result of eliminating human error. However, they are likely to present some new risks before eventually delivering on this promise. Despite their sophisticated presence detection and collision avoidance systems to safeguard against accidents, there is always a certain level of probability that they will make a mistake thanks to some momentary connectivity error.

For the same reason, cybersecurity is also a major concern. Hacking into fleet management networks controlling tens or hundreds of AMRs can cause much more serious property and bodily harm than a compromised connected doll for small children using invectives – or other amusing examples of breaches into IoT devices, where security is now a long-overdue afterthought.

Autonomy is also heavily reliant on the collection of real-time data, which makes data privacy concerns on closed factory floors – and especially in public spaces – very hard to ignore.

The need for a new liability model

At the core of the complexity of insuring autonomy there lies a feature that all autonomous vehicles from AMRs to crop-harvesting machines share: they don’t behave as humans do. In order to insure them, you need specialty underwriters who reply on subject matter experts, rendering premiums unaffordable.

Establishing liability is going to be a much more intricate process with AMRs. As accidents with self-driving cars have already demonstrated, the lines between machine and human liability can become particularly vague in this area.

But even when autonomous vehicles are the obvious ones to blame, it can get rather difficult to ascertain whether it has been the AMR hardware, the operation (security, user management, database) or functional software (navigation, path planning), the proprietary hardware or components from third parties that have led to the accident.

Machine-learning algorithms can compound the problem even further, as they enable autonomous robots to pick up new behaviours after they have been installed. The line between what the robot does because it was manufactured that way and what it’s learnt from its environment – a robotic version of the nurture/nature dilemma – will become harder to draw.

Entering the autonomy pool

Large insurers that have had policy offerings for more traditional types of robots for years are currently the most likely candidates to address these ambiguities and eliminate the grey areas that underwriters of autonomy risk need to navigate.

But what these incumbents are in acute need of is massive amounts of data to understand how these autonomous mobile systems work, what types of errors they are prone to and what the controllable and insurable risks are around their operation.

This is probably the reason why we see partnerships between big insurers and technology start-ups springing up in the autonomy space. In Korea, a country at the cutting edge of robotics, telecom firm KT Corp – in a bid to diversify into the robotics sector – has partnered with DB Insurance Co. Within the framework of this partnership, KT Corp will collect data on robotic errors and accidents for a year, which, in turn, will be fed into the insurance of service robots that DB Insurance is to develop.

In the self-driving car arena, AXA, a company owning a stake in a leading self-driving software start-up, has used UK research projects to gather data with a view to creating insurance products for autonomous vehicles.

Founded in 2020, Pittsburgh-based start-up Koop Technologies has also identified autonomy as an emerging opportunity in the insurance market. In 2021, it was selected for Lloyd’s Lab’s latest cohort, which had data and models as one of its three major themes. To supply insurers with the next level of autonomy data, it has built an API. Data collected through this API on how dropouts and disengagements affect security, as well as the ratio of miles per harmful event, will contribute to drawing more detailed and reliable risk profiles of AMRs and autonomous vehicles.

Koop, which is still in the early stages of its entrepreneurial journey, has most certainly put its finger on a problem that stands in the way of the adoption of autonomous solutions across a wide range of sectors. However, many more similar start-ups and insure-tech-incumbent partnerships need to follow in Koop’s steps to reach scale globally.

Zita Goldman

Why big firms are rarely toppled by corporate scandals – new research

Everyone makes mistakes. And that includes the world’s biggest companies, which are reliably prone to gaffes, errors of judgment and wrongdoing.

Some of these moments could even be labelled as corporate scandals – the kind of incident which shoves firms into the spotlight and places their activities under detailed public scrutiny.

But do these events do lasting damage? Does an oil spill, fraudulent activity or other unethical behaviour really affect highly valued reputations, sales and market value?

Our research suggests not. In fact, our analysis of the effects of a wide variety of business scandals shows that only rarely is the effect as severe as we might imagine.

Instead, it seems the public has a strong tendency to forget and move on. And even initial unplanned (and at the time unwanted) attention can lead to greater brand awareness, proving the old adage that any publicity is good publicity.

Take the recent furore over Spotify. In early 2022, the world’s largest music streaming service was accused by science and health professionals of offering a platform for misinformation about Covid.

So what happened next? At first, there was a dip in the stock market price of about 12 per cent when artists including Neil Young, Joni Mitchell and Graham Nash announced they were withdrawing their music from the service. This financial hiccup was followed by an immediate stock price rebound that is likely to climb beyond pre-scandal levels. Spotify went on to add disclaimers to its Covid-related content and removed some content.

So in the long term, this will probably turn out to be nothing more than a slight bump in the road for Spotify. As a business, it provides a hugely popular service and boasts 172 million premium subscribers around the world, 28 million of whom joined in 2020. How many of them will cancel their subscriptions and forgo access to their carefully curated playlists because Young and Mitchell have decided to walk?

And while it is true that the company’s business model relies on musicians and other content providers, the reality is that most artists cannot afford to not be on the platform. Giving Spotify the benefit of the doubt, it’s entirely possible it made an honest mistake and underestimated how sensitive some people have become to discussions about the pandemic. Customers will probably make peace with this.

Likewise, Netflix will doubtlessly survive recent controversies over some of its content, such as the British comedian Jimmy Carr’s comments about the Holocaust. With so many subscribers around the world attracted by the service’s wide range of content, Netflix is another example of an industry giant that can shrug things off.

And remember Facebook’s market collapse after it was linked to the personal data of millions of users being collected by the political consulting firm Cambridge Analytica? Don’t feel bad if you don’t, it lasted about seven seconds (OK, maybe seven days). The company then recovered all of the US$134 billion (£102 billion) it had previously lost in market value.

Law and disorder

So what makes some scandals stick? In our research, we found that only certain scandals tend to have significant negative effects on corporate reputations and performance. One apparently vital element is a company being found liable in a court of law. The legal process gives weight and depth to a scandal that might otherwise have quickly disappeared.

The Volkswagen emissions scandal for example, started in 2015. Seven years later, the company is still negotiating settlements in class action lawsuits brought against it for cheating on emissions tests.

The company’s share price dropped 30 per cent immediately after the scandal (it has improved since the move towards electric vehicles) and Volkswagen’s reputation is still tarnished by the event, as it continues to attract significant regulatory scrutiny, affecting its status among investors.

Similarly, years after being found responsible for the Deepwater Horizon disaster in the Gulf of Mexico in 2010, BP is still paying the price of its negligence, as it continues to be embroiled in many lawsuits. And following regulatory intervention, German financial services provider Wirecard is not even around anymore to tell the story of how €1.9 billion (£1.6 billion) disappeared from its balance sheet.

Yet without corporate culpability determined by the court of law, very few accusations stick, even in the face of media scrutiny. Without clear evidence of harm caused to a group of people, there is very little in the way of measurable negative impact, or demand for compensation for the damage caused.

As consumers, we often like to signal moral superiority and enjoy some of the drama provided by the corporate discomfort of a juicy scandal. But our research found that people’s response to a company is driven by more mundane considerations. These are price, convenience, loyalty, ease of use and habit – and there aren’t many scandals considered quite scandalous enough to make us change any of those.![]()

Irina Surdu, Associate Professor of International Business Strategy, Warwick Business School, University of Warwick

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Coinmetro's unique approach to make crypto accessible to all

Can crypto be both safe and profitable? Does there need to be a tension between compliance and the ability to trade freely – or can the two trade symbiotically?

In traditional finance, markets are centralised, with one body controlling everything that happens.

Decentralised finance (DeFi) changes that, as there is no central hub that controls markets and market flow. Many people, many computers and many nodes are making decisions. This empowers a lot more people than the current traditional markets.

The crypto market is going to fundamentally change the way traditional finance operates in the next 10 years.

Pessimism around crypto

People tend to fear the unknown and anything new. When something is not understood, most people tend to fear and are apprehensive about it.

This is a natural human process and we can see it with new technologies that are being introduced. Whether it is a microwave or an electric car, many technologies were misunderstood and mocked when they were first introduced.

The same goes for crypto, where misunderstandings abound. As with all new developments that are yet to be widely adopted, there are certain misconceptions:

-

- Myth: Volatility is a foe

The crypto market is still young and highly volatile. Think of it like credit – if used wisely, it can help you prosper. In other words, instead of fearing volatility, consider it your friend. The risks of volatility can be rewarded with high returns.

-

- Myth: Crypto attracts criminal activity

Every tool and instrument – financial, crypto or other – can be misused. Crypto is not necessarily a magnet for criminal activity nor is it above the law.

-

- Myth: The cryptocurrency market avoids regulation

It is believed that the crypto market avoids regulation. Regulation is crypto’s future. Coinmetro and others have been working to establish global frameworks comprising standards for the regulation of crypto. This will open many doors that have previously remained closed.

As the crypto market matures and we help people understand and inform them about it, this will naturally reduce the fear and help with general adoption.

Welcoming regulations

Coinmetro, the people-centric digital exchange that promotes mass adoption of crypto, is trusted for continuously working towards full regulation and licencing. Every user can be sure they’re trading safely and legitimately.

There are many more years of growth ahead of us before we come close to the size of traditional finance. For a big part, traditional finance got to the point where it is because of rules and laws. It shaped the way people interact with financial tools.

A lot of people in crypto feel the way it was shaped was done wrong. For instance, traditional finance has cut out access to certain resources of passive income and made it accessible to only a few.

In the crypto market, we have the opportunity to create frameworks so that we can guide the market to the next phase: more adoption of institutions and individuals. These guidelines can help us get to the next phase and foster maturity.

Where does Coinmetro fit in?

Coinmetro was one of the first in the industry to talk openly with regulators. We pursue regulations because we know we need them to expand into the next phase of the market. Over the past four years, we have acquired different licences and conformed with regulations around the world.

The fact that more regulations and licensing are appearing in crypto is a sign of a maturing market. A maturing market opens doors to more people.

The interaction between people and financial institutions has often been frustrating and difficult and we’re on a mission to change it. We provide 24/7 support with knowledgeable people and have the best rating on Trustpilot of all the crypto exchanges because our client experience is second to none.

We are treating people like people. We are treating their problems as our problems and this separates us from the competition. We also offer our users different vehicles of passive income without them having to understand how trading and blockchain work.

The future of Coinmetro

In the next five years, Coinmetro is heading towards a hybrid platform. We want traditional finance and crypto to be intertwined where we open doors for new clients, give access to new people and provide passive income opportunities to a much broader part of the world.Most wealth is not created with blood, sweat and tears but because people have access to tools and resources to generate wealth passively. The problem is that so far, most of the world has had no access. Coinmetro is changing this.

We Believe in Accessibility for All! Join us at coinmetro.com

By Kevin Murcko, CEO, Coinmetro

INDUSTRY VIEW FROM COINMETRO

Let’s make insurers great again

The insurance of the future will be connected, fair and personalised, and it will engage policyholders in risk prevention. Insurtech will make the insurance sector stronger and more likely to achieve its strategic goal: protecting the way people’s lives and organisations work.

I wrote about this subject in Business Reporter’s Future of Insurance in 2017. Despite the industry’s progress over the past few years, today I feel the need to reconfirm my belief in insurers’ relevancy in the future of our society.

Insurtech has come of age in 2021. We currently have numerous listed firms and even a dedicated index (HSCM Public InsurTech Index), which monitors the performance of US players. Established insurance incumbents such as Swiss Re are presenting the results of their insurtech initiatives to the financial community and demanding an adequate valorisation of these assets.

Unfortunately, a large number of the people talking about insurance innovation are generalists – who barely distinguish a loss ratio from a combined ratio – or people who don’t like insurance and see it as a necessary evil. Both categories of people miss the old days when insurtech was supposed to be only a disruption.

It is more and more frequent to hear them predicting a future where insurance will be invisible. You can even read articles where it is said that people will be insured without even knowing it: one of the less customer-centric thoughts I’ve ever heard. This seems like an archetype of miss-selling, which I doubt will be allowed by regulators.

They frequently even add a recommendation to insurers: not to waste money and effort trying to interact with the policyholders, because nobody wants to interact with an insurer. This perspective directly descends from their dislike for insurers. Moreover – to complete their “memento mori” for the insurance sector – they typically highlight the risk mitigation potential of technology.

I’m recognised in the sector for being a non-conformist. I’ve dedicated my career to insurance innovation, and I love the insurance sector. I love the insurance incumbents: they are my clients, and I want to see them thrive. But I don’t like the scenario described above where insurers are destined for extinction like dinosaurs. Moreover, I don’t think it is going to happen.

My beliefs don’t come from a crystal ball; they are based on real initiatives and results that some insurance players have already achieved around the world. I’m in the privileged position of having advised insurers and reinsurers in more than 20 different insurance markets around the world. In the first four editions of my IoT Insurance Observatory, I served and learned from four of the top five reinsurers, 11 of the top 15 European insurance groups, eight of the top 15 US P&C insurance groups and over 40 major tech players. Moreover, I had the opportunity to exchange with more than 100 insurance professionals, tech executives and leading academics across all insurance business lines and geographies, collaborating with The Geneva Association on research about risk mitigation and prevention services for the past 12 months.

I believe the insurance of the future will be connected, fair and personalised, and will engage policyholders in risk prevention.

Insurance will be connected. In the future, downloading an app that tracks your driving behaviour will be the standard, just as today it’s normal to download an app to have food delivered at home. The IoT Insurance Observatory research shows that last year 21 million cars sent telematics data to an insurance company, and 35 per cent of those were through an app. In commercial lines, any company will share the real-time data from its equipment with the player insuring it. Axa XL has already introduced a Digital Risk Engineer programme, which provides clients with a gateway that retrofits the existing facility management system and allows the loss control team to deliver recommendations more efficiently.

Insurance will be fair and personalised. The fusion of IoT and contextual data will normally be used for a more accurate continuous underwriting – managing claims better – and tailored insurance proposals. The South African insurer Discovery has used dynamic pricing in life insurance for decades, with premiums accurately reflecting the policyholder’s risk level at each renewal. Italian insurers such as UnipolSai and Generali use auto telematics data in each phase of the claim: assuring a quicker settlement where only the right amount is paid and better protecting policyholders against any fraudulent third-party claims made against them. In commercial lines, Argo Risk Tech for the general liability portfolio helps supermarket owners in demonstrating reasonable care, so providing them with lawsuit-ready protection. The French digital broker My Risk Committee is providing risk managers with real-time personalised alerts about the evolution of their risk exposure and the gap due to the current insurance coverages.

Insurance will engage policyholders in risk prevention. All the insurance coverages will come with real-time risk mitigation solutions and behavioural change programmes that are able to reduce the probability of the occurrence of problems. Insurance solutions will be characterised by a constant but discrete presence of the insurer and proactive actions when needed. In personal auto, Tokio Marine introduced an AI-enhanced camera that provides real-time warnings to the driver. Auto insurers such as Allstate and Discovery have successfully introduced advanced telematics-based behavioural programmes with daily interactions with the policyholder and rewards for safe driving .

In commercial property, Church Mutual’s investment for equipping the insured property with an IoT solution – based on the detection of water leaks and frozen pipes, and real-time alerts to the insured to mitigate non-weather-related water losses – has shown the ability to protect the policyholders and a robust return for the insurance company. Moreover, in workers’ compensation, StrongArm Technologies’ wearables are already used by tens of thousands of employees to enable insurers to reduce expected losses, both directly with real-time alerts and indirectly with data-driven recommendations delivered by the loss control teams.

There are already some insurance best practices that have achieved a 40 per cent daily active users ratio in their IoT-based initiatives, which is not so far from the 60 per cent achieved by social media players. This demonstrates to the insurers that engagement is an achievable target, and they can evolve from the historical zero interaction (excluding the annual request to pay the premium) approach.

All the pioneers described in the article have already started creating the future of insurance. This is demonstrating to the sector the feasibility of this business transformation, and their achievements will push more and more players to invest in developing the necessary capabilities for innovating the way they are doing business. We have already seen this happening in the personal auto telematics in the US, with Warren Buffet acknowledging the relevancy of telematics and commenting on Geico’s investments in order to close the gap with competitors.

This should give a sense of urgency to all insurers. Although a competitor’s product can be replicated in a few months, capabilities require time to be built and internalised in the organisation. A capability gap will require years to be closed.

by Matteo Carbone, founder and director of the Connected Insurance Observatory and a global insurtech thought leader.

Behind the crypto hype is an ideology of social change

Ads for blockchain, NFTs and cryptocurrencies like Bitcoin seem to be everywhere. Crypto technologies are being promoted as a replacement for banks; a new way to buy art; the next big investment opportunity, and an essential part of the metaverse.

To many, these technologies are confusing or risky. But enthusiasts ardently promote them.

As a cybersecurity and social media researcher, I’ve found that behind the hype is an ideology about social change: Hardcore enthusiasts argue that crypto will get people to trust in technology rather than government, which they see as inherently untrustworthy. This ideology leads people to encourage its use while downplaying its risks.

The true believers

My colleagues and I studied almost three months of discussions on Reddit forums about cryptocurrencies to try to understand how people talk about crypto and Bitcoin. The loudest voices on the forum were a group of crypto enthusiasts who called themselves “True Bitcoiners.” Unlike technology enthusiasts or crypto marketers, “true bitcoiners” didn’t talk about technology, or about their own use of crypto. Instead, they talked about trust and corruption.

These crypto enthusiasts often cite examples of what they see as government corruption and corporate corruption. They recognize that society depends on governments and corporations setting and enforcing rules, and they complain that people are stuck with these “corrupt” institutions. Corruption, they say, is an inevitable flaw in humanity and leads to trying to control and mistreat others.

The enthusiasts see Bitcoin, blockchain and other crypto technologies as providing an alternative to the corruption. They argue that these new technologies are “trustless” and don’t depend on institutions. You can buy and sell things using bitcoin without checking with a bank or using government-issued cash.

These two beliefs – that governments are corrupt and that crypto avoids that corruption – are common among the crypto enthusiasts we studied. But enthusiasts go one step further. They seek change. They want to change who has power and who doesn’t.

They argue that crypto is how that change will happen. For crypto enthusiasts, using crypto isn’t just a way to buy and sell things. By using crypto technologies, they argue, society will become less dependent on governments and corporations. That is, using crypto – and getting as many people as possible to use it as much as possible – is a way to change the world and take power away from governments.

Pushing an ideology

These beliefs about who should and should not have power in society embody an ideology. An important part of the crypto ideology is that this change can’t happen unless people use crypto. The technology and the ideology are tied together.

For many of these enthusiasts, recommending crypto to other people is not just a technology recommendation. To them, buying and selling crypto is a form of political and social activism. They argue that buying crypto will remove corruption and change society to trust technology over government.

This ideology is a more extreme version of technolibertarianism, which seeks to replace government with technology. Like technolibertarians, true bitcoiners want technology to control society. But they focus on financial and economic control more than civil liberties. And because promoting crypto is part of this ideology, crypto has often been compared with a religion.

Crypto dangers

An important aspect of any ideology is the way it emphasizes some dangers and downplays others. True bitcoiners emphasize the problems with government corruption. But they downplay the financial risks of crypto. The price of Bitcoin fluctuates wildly, and many people have lost money buying crypto. Crypto wallets are difficult to understand and use, and fraudulent transactions are difficult to reverse.

Crypto enthusiasts frequently downplay the technology’s risks to people and society. They also dismiss the valuable role that governments and corporations play in protecting people’s money, providing insurance for bank accounts and returning money that’s been stolen.

Beliefs in crypto’s ability to create social change are also overstated. Crypto technologies don’t necessarily eliminate corporations or avoid government control. There are private, corporate blockchains and many government regulations about cryptocurrencies. As I see it, simply using the technology doesn’t necessarily lead to the social change these enthusiasts seek.

Rick Wash, Associate Professor of Information Science and Cybersecurity, Michigan State University

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Insurance of the future: A world of evolution or revolution?

The insurance industry dates back more than 300 years – and insurers need to change their business models to survive

We live in a world where our data is shared digitally across many platforms and ecosystems. Consumers are inherently digital and consider omnichannel interactions and faster transaction processing to be the norm, not the exception.

Yet in the insurance sector, an industry steeped in tradition, companies are yet to fully embrace digitisation and keep pace with customers’ changing lifestyles and needs.

Business processes and customer touchpoints, embedded in organisations for decades, are being swept away by online and app-based companies powered by the Cloud, APIs (tools enabling products, services and systems to easily integrate with a network of partners), data analytics, mobile devices and social media.

Looking ahead, insurers with technology platforms that allow them to instantly respond to market demands, trends and disruptors, develop new business partnerships, source new revenue streams and offer additional products and services – while guaranteeing online responsiveness, performance and reliability – will thrive.

Those who fail to adopt new business models, innovate quickly and find additional ways to engage with existing and new customer bases will inevitably cause their own demise.

Composable enterprises

Insurers of the future must morph into composable enterprises. This maximises their ability to build, assemble and reassemble core business elements, seize market opportunities and respond to disruptors and threats while maintaining resilience.

Gartner, in its 2022 Insurance Industry Trends survey, found only 8 per cent of insurance CIOs have a composable enterprise strategy in place – so what’s the starting point for leadership teams?

- Focus on making changes to growth strategies, architecture and technology

- Adopt a modular mindset

- Add new components to existing legacy systems (to support new ecosystem connections and exposure to new markets/revenue streams)

Insurers need to answer questions around future business plans, ecosystems and whether their architecture has the structural capability to adapt and repurpose propositions, with composable software components in place (these interconnected pieces drive the technology necessary to support business growth).

Rather than remove legacy systems, which have great business value, businesses should support them with modular technology platforms such as microservices architecture. It connects separate or ‘decoupled’ elements and supports interlinked software applications, enabling communication via the Cloud. They can then be managed, modified, tested, deployed and scaled, without affecting the wider operation.

Kleber Bacili

CEO at Sensedia

INDUSTRY VIEW FROM SENSEDIA

Supercharging customer experience for financial services with Voice AI technology

Kun Wu, Co-founder and Managing Director, AI Rudder

Customer experience will never go back to how it was pre-Covid. The pandemic has accelerated digital adoption and changed consumption habits, from on-demand video streaming, e-commerce and food delivery to more digitalised services such as digital banking and payments. Almost everything is available at consumers’ fingertips as 24/7 availability becomes the new normal.

The rise of a hyper-connected and hyper-convenient world has also led to an exponential rise in call volumes at customer service centres across geographies and industries. As a result, businesses struggle to keep pace as pandemic-weary consumers run out of patience and want both speed and flexibility in their digital interactions.

While some of the world’s biggest brands have taken innovative approaches to meet this new standard of customer service, responding to new customer expectations would mean a radical departure from the status quo.

Faster, more intelligent on-demand customer support

In banking and financial services, customer support functions are oversubscribed. However, things would look very different if your top call centre representatives could work 24/7 without fail. AI Rudder can make this vision a reality through advanced Voice AI technology.

Our Voice AI uses automatic speech recognition (ASR) and natural language understanding (NLU) to process human conversations. Our machines can receive and interpret customer intent in voice communications. Not only that, they can respond and communicate on a near-human-seeming level of intelligence.

From payment reminders to debt collection to quality assurance, Voice AI assistants can take every repetitive task off your customer support’s workload, thus freeing them up to focus on more complex conversations that require a human touch.

Bringing the human touch with AI-powered voice automation

Adopting AI does not need to come at the expense of human relationships. While customers may feel sceptical about automated solutions using AI, the technology helps bridge fundamental gaps in delivering exceptional CX.

A Voice AI solution can help companies extract precious data from incoming customer calls and existing recorded conversations. This data can provide banking and financial services companies with valuable insights that would otherwise be overlooked, and which can even help forecast peak demand periods based on identified patterns. Insights from AI-decoded conversations can also lead to product innovations and service optimisation, making your company stand out in a saturated market.

Customer experience teams can even use real-time data from Voice AI to predict issues before they occur, such as a sophisticated phishing scam targeted at customers. By alerting your customers of potential threats, you’re building greater confidence that their assets are safe in your hands.

Besides improving customer experience, businesses can use AI-driven insights from voice conversations to identify gaps in knowledge across client-facing teams. This precious information can feed into training programs, helping you build a top-class customer service department.

Working with banks and financial services companies around the world

Founded in 2019, AI Rudder develops advanced voice AI technology to help businesses solve B2C communication challenges. We work across various industries, including banking and finance, fintech, insurance and e-commerce.

More than 200 companies around the world use our platform today to augment their human agents with our AI voice assistants, maximising profits, efficiency, and scalability.

With our Voice AI solution, businesses can increase the scale, speed and quality of their customer experience while reducing operational costs. Implementation won’t be an issue because AI Rudder’s platform also has an open API that makes integration and deployment fast, easy and seamless.

Change is upon us. Are you ready?

With businesses overwhelmed by customer requests during Covid-19, Voice AI has proven to be a natural choice – especially in financial services and banking – to provide the agility needed to deal with the business impact of the pandemic.

AI Rudder’s enterprise-ready Voice AI assistants can help you face tomorrow’s challenges today. Visit us at www.airudder.com to find out more or contact us to arrange a product demo.

INDUSTRY VIEW FROM AI RUDDER

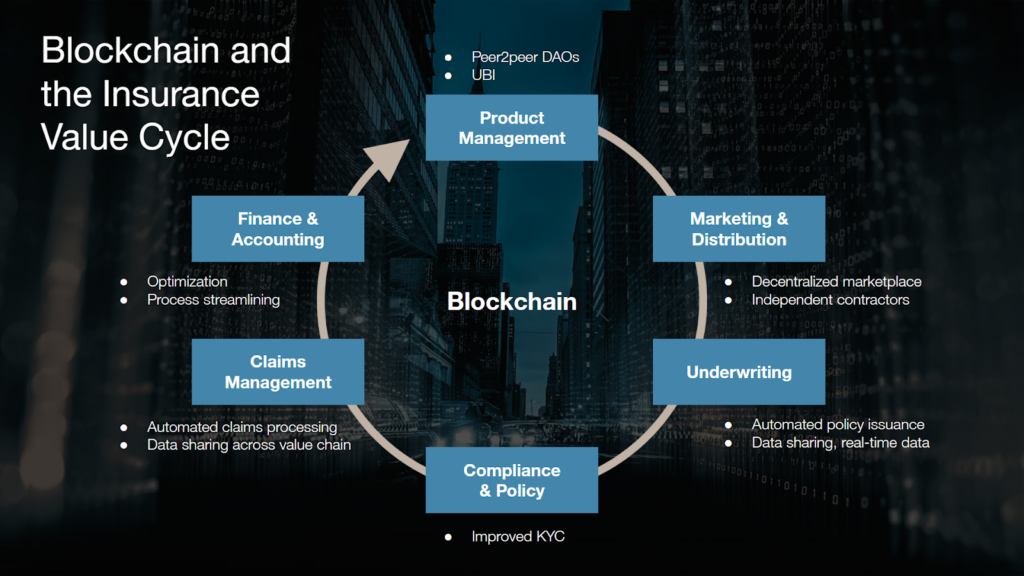

Blockchain: threat or opportunity for the future of insurance?

Could blockchain technology bring a simpler, more efficient way to provide, buy and consume insurance?

Looking at the global market for blockchain-based insurance, the figures don’t seem particularly impressive. In fact, research by Markets and Markets expects it to reach just £1.39 billion by 2025. A paltry sum compared with the anticipated value of the global insurance industry, which Swiss Re Institute expects to top $7 trillion in 2022.

But the compound annual growth rate (CAGR) and the figures tell a different story. The growth in traditional insurance is estimated in the low-to-middle single digits, whereas blockchain-based insurance has a CAGR of almost 85 per cent. In fact, Gartner estimates blockchain will top $3.1 trillion in new business value by 2030, which represents a huge opportunity for insurance companies and their InsureTech vendors.

It’s time for change

As the industry has grown and flourished, so has it fragmented and atomised, with insurers at one end, claims processors at the other – and reinsurers, managing general agents and brokers in between – all consuming a slice of the pie.

It is in this environment that inefficient exchange of information has also flourished, as multiple parties with different priorities communicate with each other using different systems and processes – to the point where the industry wastes a lot of time, money and resources just maintaining a “complex ecosystem”.

Blockchain can help overcome many of these challenges.

Simplifying complexity

Blockchain’s decentralised quality means it can simplify, expand and accelerate information exchange, while ensuring anyone on any machine, software or system can access the blockchain. This is made even more powerful by ensuring only authenticated, approved users can write data to the blockchain. Moreover, blockchains are protected by consensus protocols, which reduce the likelihood of fraud and malfeasance.

Automating the claims process

Blockchain also can help do away with manual claims processing and reviewing with smart contracts. For example, insurer and insured create a digital agreement (a smart contract) that says every time the latter drives their car, they’re insured up to, say, $5 million, with a $500 excess. And through the use of “oracles”, which connect blockchains to external systems, predetermined conditions can be fed into the blockchain, activating a smart contract based on real data from the outside world.

In fact, Lemonade has built its entire business case on the fact that the vast majority of claims can be processed nearly instantaneously.

Blockchain can empower every stage of the insurance life cycle

Dynamic insurance or usage-based insurance

Dynamic insurance made a big impact during the Covid-19 outbreak, with many car insurance users speaking out against paying a yearly premium when they were unable to drive. Since then, however, usage-based insurance has skyrocketed, affecting various fields. But most interesting is the use of external real-world data to calculate premiums.

Today the technology exists to tell if a driver is drunk behind the wheel, speeding, running red lights or driving without due care and attention. Link all this data together and you can create dynamic products that charge people premiums based on their risk in real-time, rather than on “average”. This would certainly make car insurance fairer and cheaper, and limit low-risk drivers footing the bill for “boy racers”.

The insurance industry is already moving towards a pay-per-use model. With the rise of car clubs and fractional ownership, paying for car insurance by the hour or the day is now commonplace. The trick for insurers will be to package this into a smart contract that’s automated, transparent and ID-verified.

A picture of health

Similarly, health insurers could take a comparable approach using real-time health data from wearable apps such as Fitbit and Apple Watch to adjust premiums by the hour, day or week. Again, technology exists to achieve this but using the blockchain to record and feed all this personal data would allow insurers to link it easily and directly to a specific individual.

Added protection

You can also eliminate policyholders’ concerns around data security by using zero-knowledge proof (ZKP), so individuals have complete control over who accesses, shares, or uses their personal data. Ultimately, it’s about creating tailored, equitable and best-value insurance to meet an individual’s specific lifestyle needs and real-life risk profile, not one based on the average.

Peer-to-peer insurance

On the downside, blockchain, for all intents and purposes, could also democratise insurance. It allows groups to pool their premiums, self-organise and self-administer their own insurance against a certain risk. Similar to peer-to-peer lending, and other DAOs, peer-to-peer insurance would allow a group of people to effectively set up their own insurance firm. Each pool member has a say over when insurance is or isn’t paid out, and smart contracts could go a long way in making the criteria for pay out simple, removing the need for any intermediaries.

There’s also the benefit of full transparency, including on fees, from the claim (when the smart contract is triggered) to payment. This makes the whole process smoother and faster as all the data, documentation and verification has been done already during the process.

Instant finality, compliance ready

In insurance, it is important transactions take place and are recognised in real-time. Recording data two days later won’t cut it. Any blockchain solution has to offer instant finality, so that transactions are recognised, finalised and executed simultaneously.

Insurance is also highly regulated, and insurers can’t insure without knowing who a counter-party is, where their money’s coming from and where it’s being sent. In fact, KYC non-compliance can result in huge fines. So having an integrated ID layer at the protocol level is a must when it comes to the highest levels of security, transparency, legal enforceability and the inevitable regulatory compliance.

Last word

Imagine a world in the not-too-distant future where an individual’s digital identity is controlled via the blockchain. For the insured, it means having complete control over their information and who gets to see, use or share it (whether the actual or ZKP information). For the insurer, it means the ability to tailor insurance based on countless off-chain data sets in real-time to make premiums more attractive to certain risk profiles. But perhaps more importantly, it’s about simplifying and automating insurance, streamlining processes and ensuring people pay premiums that reflect their real-life exposure to specific risks. All part and parcel of today’s empowered consumer.

Concordium’s decentralised layer-1 blockchain technology offers unrivalled security, privacy, transparency and control. It is the only layer-1 on the market with an ID framework which ensures accountability, responsibility and certainty in an uncertain world. Alongside our Reg DeFi Lab we understand that the DeFi space will continue to evolve and gain traction with enterprise and institutional clients. That is why we are partnering with start-ups and tech giants alike, looking to take advantage of blockchain technology. Visit Concordium to find out more.

INDUSTRY VIEW FROM CONCORDIUM

How blockchain can transform insurance

In 2020, more than 30 per cent of small businesses were uninsured, even though 75 per cent of business owners reported experiencing an insurable event that year. One pivotal reason is that navigating the traditional insurance market can be challenging for small businesses, which can face long and complicated claims processes – if they’re even able to secure insurance in the first place.

Blockchain-based parametric insurance can help address some of these needs as it issues payouts automatically according to predetermined events (rather than through a manual and inefficient claims process). Developments in blockchain technology are making parametric insurance solutions from specialised providers cheaper, faster, and more accessible for social good.

Parametric insurance smart contracts are digital agreements on blockchains with conditions attached to their execution (if x occurs, execute action y). Oracle networks, such as the clear industry-leader Chainlink, provide the necessary real-world information from outside the blockchain to confirm that conditions for payment have been met and that the insurance company should therefore pay out the claim. Blockchains keep an immutable record of transactions, providing accountability. Smart contracts improve efficiency by automating contracts. And oracle networks, which connect blockchains to real-world data, validate that an event did indeed occur and that the automated payment cannot be manipulated.

Here are four blockchain-based parametric insurance products that small businesses can use to maximise their operational security and minimise risk.

Crop insurance

According to parametric crop insurance provider Arbol, $1 trillion of agricultural risk is not insured. Much of this risk is located in developing nations, where many farmers do not have access to insurance at all. Smaller farmers, or those facing highly variable weather conditions, may also struggle to receive the coverage they need. Climate change will exacerbate the need for crop insurance as weather patterns become less predictable and extreme weather events become more frequent.

Parametric crop insurance that helps farmers secure economic protection is already live, with providers such as Arbol making it available to anybody with a smartphone. Arbol uses Chainlink to create insurance contracts around weather data from the National Oceanic and Atmospheric Administration (NOAA). For instance, a farmer could receive a payout if data from the oracle network indicated their region received less than 20 inches of rain over a two-month period.

Access to insurance prevents farmers from needing to uproot their families and abandon their farmland in years where they face unfavourable weather conditions. They can also benefit from quickly disbursed aid, while insurance providers are assured that the process is accountable, transparent and fraud-proof because all activity happens on-chain and payouts are determined by verified external conditions.

Flight and travel delay insurance

Anybody who flies knows the slow dread that accompanies the realisation that a flight has been delayed or cancelled. Though airlines will compensate fliers for cancellations, delays may cause them to miss important events or connecting flights with little recourse other than booking new, expensive last-minute replacements. Insurtechs are emerging to meet flight insurance needs, and providers leveraging blockchain technology, such as Ensuro and Etherisc, will help the space advance further. Parametric insurance allows a traveler to quickly repurpose the funds and purchase a new ticket, as compensation is automatically distributed as soon as a flight is cancelled or delayed.

Logistics and supply chain insurance

Businesses are often uninsured for improbable events that nonetheless have the potential to be catastrophic. For example, prior to the Covid-19 pandemic, very few businesses had purchased (or even had the choice to purchase) pandemic insurance, leading to a last-minute surge in demand. Parametric insurance for logistics can cover highly variable and rare events, from pandemics to extreme weather. Additionally, using oracle networks to connect IoT sensor data to blockchains, supply chain companies can purchase parametric insurance to mitigate any potential quality control issues such as losses from shipment quality issues, particularly for perishable goods.

One of the benefits of parametric insurance is the ability to tailor contracts. For instance, a supply chain company with operations vulnerable to winter storms may take out a policy to protect against disruptions. It may not be clear when, or to what extent, an ice storm could lead to delays. A parametric insurance policy can source NOAA data about ice accumulation in the relevant region and pay the policyholder accordingly. Whether the storm delays shipments by hours or days, the supplier is protected.

Connecting IoT device data to blockchains via oracles can also improve shipment quality data. Refrigerated unit sensors could inform a parametric insurance policy that pays out if temperature fluctuations compromise product safety. Oracles connected to sensors such as PingNET would trigger the payouts. With these contracts, payouts are much faster than the quality tests typically required for claims processes for spoiled goods. There’s also the added benefit of knowing that when a shipment arrives, it is in good condition, as safety issues would be recorded on-chain prior to delivery.

Live event insurance

Live events such as concerts and sports are sensitive to inclement weather (as well as, it turns out, rare, catastrophic events such as pandemics). Parametric insurance can help, as these niche events are not likely to secure insurance through traditional brokers. Event organisers can use parametric insurance to absorb cancellation losses, helping them mitigate risk and smooth out the impact of cancelled events.

Parametric insurance would protect organisers in the case of event cancellations that require refunding all attendees or rescheduling, which creates additional logistical challenges. However, parametric insurance can also help if event attendance is simply suppressed (for instance, if icy conditions prompt 20 per cent of attendees to skip the event because they don’t want to drive). Variability can be built into the parametric insurance contract, allowing event organisers to secure the exact amount of coverage they need. Mark Cuban, an investor in the blockchain-based climate data project dClimate, pointed out in a recent Wall Street Journal interview that the Dallas Mavericks could benefit from this type of weather insurance.

To learn more please visit chain.link/use-cases/social-impact

INDUSTRY VIEW FROM CHAINLINK LABS

How artificial intelligence can create an attractive user experience

Leveraging automation can help tap into the power of personalisation in the financial services sector

Bismarck Lepe, Founder and CEO, Wizeline

The pace of digital innovation has raised the bar for customer experience, and there are two market trends in particular that financial services providers must consider to remain competitive against their digital-native counterparts in fintech. The first is that the number of customers who favour digital channels has increased dramatically in recent years, and the second is that customers expect services to accommodate individual circumstances and preferences in real-time – especially when it comes to personal finances.

While a strong digital transformation roadmap can help your company adapt and scale to meet the demand for more digital experiences, realising the level of personalisation customers have come to expect requires a more complex approach.

The most popular method for personalisation to date, segmentation, classifies users based on specific types of data. This is captured via demographics, purchase history and other details extracted from your CRM or interactions with your support team using text mining — including other clever sources that have been engineered into the user experience (UX). Your data science team can use this data to group users into clusters labelled with actionable names. These clusters are used to train a model for classifying new prospects according to the labels, and your machine learning operations guarantee that the model performs as expected when it goes into production. Equipped with these insights, your marketing team is ready to increase conversions, right? Not so fast.

While segmentation can offer valuable insights, this wealth of information is only as good as the overall customer experience. For example, what good is it to know which segment a customer belongs to if it takes too long to process their loan application or reply to their enquiry? That’s where automation introduces an opportunity for optimising your approach to personalisation. Automating business processes at scale via robotic process automation (RPA) can increase your firm’s productivity and accuracy. Since RPA is no longer limited to performing menial, repetitive tasks, adding it into the mix with AI modules will enable the automation of complex end-to-end tasks involving judgment, image recognition and text processing.

Think about how much time you can save your teams by automating tasks, enabling them to focus on more complex and creative projects. There’s also the added value you generate by preserving and scaling the know-how that is embedded in your business processes. Furthermore, you can use smart assistants to provide a better service by not only understanding the intent of your customers but also having access to the relevant knowledge bases.

So far, so good. You can understand your customers and provide low response times via automation. But is this enough? Are you providing a best-in-class customer experience? Well, that depends on whether you are constantly improving your products.

Javier Gagliardo, Chief Business Officer, Wizeline

Building continuous testing techniques into your product development lifecycle is just as important as the initial product design and implementation. A/B testing is one such technique that businesses leverage to hypothesise about how to improve engagement and conversions. It is useful for testing hypotheses about user behaviour through experiments based on well-defined modifications to the UX. By applying this process repeatedly, you will find that certain changes produce the desired results.

But even with this scientific approach to improving UX, you may fall short in meeting more complex demands for tailored services.

Imagine for a second the potential value-add if your UX could adapt to the particular cognitive styles of users in real-time. This is feasible with the application of cognitive architectures – theoretical models that account for complex cognition – in AI. Cognitive architecture provides the modules (visual, motor, procedural, declarative, etc.) and mechanisms to communicate among the modules. This requires the knowledge necessary for the task and the means to see and interact with the graphical interfaces. You can also control the model’s behaviour with reinforcement learning, which rewards those actions that help to achieve your goals.

With a cognitive model in place, you can track the cognitive, perceptual and motor actions of users down to the millisecond. At this level of granularity, it’s easy to detect subtle differences in the psychomotor abilities of the end-users – your customers – and understand that some of them use memory-intensive strategies while others rely on efficient perceptual actions. By combining a cognitive model with your clickstream data, you can start adapting interfaces to accommodate the individual preferences of your customers in real-time to curate the ultimate customer experience – a clear gamechanger for financial services.

Wizeline helps financial companies leverage leading technologies to accelerate digital transformation and deliver better customer experiences. Visit wizeline.com or email consulting@wizeline.com to learn more.

By Aníbal Abarca, Chief Technology Officer, Wizeline

INDUSTRY VIEW FROM WIZELINE

Making the home ownership dream a reality

Estelle and her husband James rented their home in the Sacramento Valley area of California for years. They never thought they would become homeowners, but when their landlord passed away and the chance to buy their house came up, it seemed like too good an opportunity to turn down.

As is often the case, the process wasn’t entirely straightforward. The landlord’s family wished to avoid involving estate agents, and when Covid-19 hit, lenders grew reluctant to loan money to first-time homebuyers. A historic tax transcript issue also led to unforeseen complications.

Then Estelle and James came across Lower. It was the only lender that was prepared to help them become first-time homebuyers and it helped the couple every step of the way, including navigating the requirements for a loan.

Months later, the couple owns their first home and have embarked on renovations to add their own personal touch to the place they have rented for a quarter of a century. “We are still in disbelief; even when we were signing the stack of papers we were questioning if we are really the owners now,” Estelle said. “But we are! We’ve always called this place home but now it’s officially 100 per cent ours.”

Buying a home can be challenging, particularly for first-time buyers — and especially so at the moment, with rising prices and a shortage of supply. According to the National Association of Realtors, home prices have risen by 30 per cent since 2019, while the number of homes for sale is at a record low. The average home is about $80,000 more expensive than it was pre-pandemic.

Trying to help people such as Estelle and James was the reason why Dan Snyder co-founded Lower in 2014. “We wanted to make it more accessible for consumers,” he says. “Instead of an intimidating and complex journey, where they’d have to go and talk to a big bank and maybe get turned down, we wanted to open up the whole process.”

Estelle and James

The business provides a one-stop shop to enable access to anything to do with the home-buying process, ranging from savings accounts for people to build a deposit to finding an estate agent or buying insurance to protect their biggest asset. It incorporates several unique features, including the ability for people to take a lifestyle-based home readiness assessment, which can help to determine whether buying a home is the right move for people at that time.

“As a fintech lender, we do everything from the origination to the service,” says Snyder. “We think about it from the standpoint that, no matter where the customer is in their home-buying journey, we want to be able to help them along the way. We’re trying to break down walls. If you bank with us, you shouldn’t need to apply for a home loan or check if we can get a better insurance rate for you. We should just give you a better insurance rate.”

Lower has recently launched HomePass, enabling customers to offer cash and stand out in a highly competitive market. Buyers are able to win the offer, backed by a deposit, and then get their mortgage behind the scenes.

The mobile experience is a key piece of Lower’s offering. “People spend an average of five hours a day on their phones – which is more than they do for most things such as exercising, eating and sometimes even sleeping – so we felt like a mobile-first experience, whether it’s for banking with us or during the mortgage process, was important,” says Snyder. “We built it with a consumer-obsessed mindset, based on years of experience of having worked at banks and mortgage companies that weren’t changing with the times.” Around 40 per cent of Lower’s customers are first-time buyers, well above the national average percentage of total homebuyers.

The majority of customers come directly to Lower, but the business is also building relationships with estate agents, builders and financial brokers, which can be particularly useful if people are considering buying a house in an area they’re unfamiliar with. “That can help them land the home,” Snyder says. “Realtors are still very powerful conduits in the US housing market, so we’re a big supporter of our realtor network.”

Over the past eight years, Lower has grown from seven to 1,500 employees, but Snyder is keen to stress that its focus remains very much on home ownership. “We’re a mobile-first consumer finance platform,” he says. “We help people save, plan for and buy their house and then we’ve got an estate agent arm to keep it all together. We’re not trying to do commercial loans, and we don’t do stock trading. We’re going to stick on the same path of unlocking wealth through home ownership. We want to be the best at this.”

Estelle has a very simple message to anyone who thinks the dream of home ownership may be out of reach. “Don’t give up,” she says. “There may be a few hurdles here and there, but if you want to work with a firm that really cares about helping you achieve your goal of owning your own home, Lower is there to help you. We have already recommended it to others. In the future, if the need arises, we will reach out again. Lower can make it happen!”

INDUSTRY VIEW FROM LOWER

The three forces driving 2022’s biggest payment trends

Ralph Dangelmaier, CEO, BlueSnap

In the past two years, we have seen an unprecedented acceleration of digital payment adoption across all industries. For many businesses, 2020 saw an acceleration that analysts didn’t expect for another seven years, according to McKinsey. And the business transformation journey is still going.

This year, leaders will continue to fine-tune the processes they’ve put in place and will begin to look at digital payments to drive business impact and the bottom line rather than only playing a supporting role. Our eBook, 2022: The Year of Optimizing Payments, offers key payment trends focused on three business goals: driving growth, elevating the customer experience and optimising payments.

Driving growth

Businesses of all types have come to understand digital payments lead to higher conversion rates, an increase in successful payments and more profitable geographic expansion.

In 2022, organisations will continue to build on the success they’ve already achieved with digital payments, using payment optimisation tools to drive higher conversions and growth. Tools such as intelligent payment routing and failover technology help increase authorisations and allow companies to take full advantage of their investment in digital payments.

We’ll also see even more businesses moving into the global marketplace. With digital payments, companies can sell to customers worldwide and the right payments partner can make international payments simple and efficient. By 2027, the value of all cross-border payments is projected to be $250 trillion, so now is the time to be sure your payment solution will help you make the most of the global marketplace.

Elevating the customer experience

Customers have quickly become accustomed to the convenience and ease of use that digital payments offer. More B2B businesses than ever are now providing online payments, and 53 per cent of business leaders want to accept more digital payments, according to the Progressing Payments report. Accounts receivable teams are seeing the benefits of sending electronic invoices and receiving digital payments. In 2022, businesses will offer even more features to get the most out of their customers’ affinity for going digital.

Businesses will provide more payment options and localise each customer’s payment experience. Whether accommodating cashless customers with alternative payment methods or offering more flexible payment options – such as buy now, pay later – these efforts to cater to customers’ payment desires will ultimately mean more sales and revenue.

Optimising payments for the best ROI

The quick shift to digital payments, growth into global markets and the digitalisation of AR processes was the result of the pandemic for many businesses. This year, we will see these businesses moving away from the patchwork solutions they initially put in place to more cost-effective, strategic payment solutions that provide positive ROI. Businesses will move full steam ahead to optimise their authorisation rates, consolidate vendors, reduce their tech debt and fully automate their accounts receivable operations.

Included here will be how businesses approach their security, fraud prevention and compliance on a global scale. Businesses will be partnering with payment platforms that can offer strong solutions in this arena.

These goals (and more) are discussed in-depth in our eBook, 2022: The Year of Optimizing Payments

By April Grudier, Vice President, Marketing and Partner Strategy at BlueSnap

INDUSTRY VIEW FROM BLUESNAP

Building blocks: emerging tech and the future of insurance

What insurance coverage looks like and how we engage throughout the insurance experience will be different over the coming decade. Forces such as changing customer behaviour shaped by COVID; regulatory burdens imposed by ESG and consumer data protection; flocks of new and unexpected competitors; and worsening climate and cyber risks are reshaping what the insurer of the future will look like.

Insurers are prepping their organisations for change. When we asked insurance business and technology decision-makers working worldwide about their 2022 business priorities, “strengthening their economic growth potential” was identified as a critical or high priority by all 131 respondents. The recipe for building a foundation for growth spans people, partners, processes and, of course, tech. That enabling tech spans artificial intelligence, low/no-code, robotics, APIs, Internet of Things (IoT), edge, 3-D printing and even lifespan lengthening epigenetic clocks. So, how will these technologies and others shape insurance offerings and experiences over the coming decade? Insurance will become:

- Greatly connected. IoT, edge computing, AI and latency-lowering 5G/6G networking puts digital and computing resources close to where data is consumed and exhausted. Whether it’s a software update for an autonomous vehicle, the wearables that keep workers safe and equipment operating at full capacity on construction sites or even a smart carpet that can detect and mitigate the claim of a water leak, connected tech will keep drivers and workers safer and anticipate, mitigate and even prevent claims.

- Deeply embedded. Selling and using insurance is being mashed into other buying and using experiences, expanding distribution sales opportunities for insurers, often with a very low cost of sale. Long-time embedded insurance sellers include payroll processors such as ADP, while Intuit QuickBooks’s partnership with SimplyInsured provides group benefits to QuickBooks’s small business employers. Auto and tire manufacturers, telcos, petrol retailers, rental property managers and tech platforms such as Google, Apple, AWS and others are exploring insurance distribution adjacencies.

- Increasingly automated. “Hands-free” and “touchless” are now the hallmark goals of insurance underwriting and claims. In conversations with more than 40 life insurers last year, we heard big goals of at least 75 percent straight-through processing of new life insurance underwriting decisions, with start-ups having even more aggressive ambitions. That goes for claiming, as well. Australian insurer Westpac turned to its workforce of software robots to immediately scale up its claims operations during the country’s recent widespread flood disasters.

- More invisible. Data and analytics, AI, robots, sensors and others deliver high degrees of convenience for the insurance customer. And as the nature of engagements shifts from reactive to anticipatory, there’s danger ahead. Insurers will be challenged to remain relevant as they fade into a backdrop of a larger experience. Nicole Myers, Chief Underwriter at Ethos, nailed the challenge in remarks she made at the April 2022 InsurTech Hartford Symposium: “Positive friction is a really important dialogue for our industry. We've become obsessed with disappearing into the background, but financial decisions are perceived differently than impulse Amazon purchases.”

- Most immersive. Insurance innovation labs have produced plenty of augmented/virtual/mixed reality experiments, and some have turned into commercial offerings. US workers compensation insurer, Texas Mutual, provides its Safety in a Box virtual reality training solution to loss control and facilities managers to help reduce workplace injuries. And in the next step to all things AR/VR/MR, immersion experiences combine multiple senses – sight, sound, touch and even scent – to “trick” users with more realistic experiences that provide insights to help insurance staff develop empathy.

By Ellen Carney, Principal Analyst, Forrester Research

Smarter auto insurance for a hyperconnected world

Telematics is becoming a necessary capability for dealing with the future of insurance

Insurance is about assessing, managing and transferring risk. Telematics enables insurance to be done in a smarter way by offering a personalised experience to policyholders. The reasons for using telematics data are wide-ranging: improving customer engagement; impacting core insurance processes; using the new knowledge about policyholders and their risks; and improving sustainability and the creation of value-added services.

Earnix has mastered the usage of this data for pricing sophistication, making telematics data available as a core component of the analytical rating engine. Such steps enable carriers to fully leverage the availability of data across the board to rate and price consumers accordingly. The same data also has a valuable personalisation appeal to make commercial offers to customers and use those elements as a strategic retention tool when it’s the right time to do so.

By doing so, insurance carriers will better understand their customer profiles and risks, improving sales and profitability and making the usage of telematics data a concrete opportunity in all geographies.

The US market has focused the most on the usage of telematics data for enabling continuous underwriting use cases. Robust evidence has clarified the economic benefit of sophisticated telematics-based pricing, and more large incumbents are exploiting the opportunity to personalise their pricing.

We believe that this pricing approach will help usage-based insurance (UBI) move to the next level of adoption, convincing motor insurers that driving data is no longer something to experiment with just because competitors have it. It’s truly an element that cannot be disregarded in managing today’s motor business.

At a global level, more than 20 million policyholders exchanged telematics data in 2020. Some insurers worldwide have already successfully introduced a wide range of telematics-based applications. However, motor insurance telematics is still at the beginning of the development curve. Based on research from the IoT Insurance Observatory, there are less than 10 insurers globally with a portfolio bigger than one million telematics-based policies.

In Europe, usage of telematics data has not yet scaled to its full potential and still is rarely used to assess drivers’ risks for modelling. UBI is either a small niche or telematics usage is limited to risk selection and claims management where it has scaled. The two most advanced markets have been Italy and UK, with recent developments in Germany.

In the UK, UBI is still considered a product for young drivers. The opportunity to move from a niche underwriting solution focused on younger and low-mileage drivers to a mainstream solution broadly applied to motor portfolios has still to be addressed.

Italian personal auto insurance is still globally in a leading position regarding telematics portfolio size, value proposition towards its customers and demand for such services. In this market, telematics was already present in 21.5 percent of personal motor policies at the end of 2021. Telematics data are used across various use cases in the insurance value chain, with many insurers mastering its usage for self-selection of the risks, for claim management and for delivering services to policyholders, increasing the robustness of business cases for the insurance company.

European markets can leverage the recent development in the US market, where the transition to the less expensive mobile-based approach has driven growth and made the business cases more sustainable.

Meanwhile, technology and the usage of data in our society have scaled very fast. Consumers love to interact with their smartphones and digital tools and large tech companies have managed to address consumers’ needs based on the collected data with highly targeted offers that consumers seem to like. A mobile-based approach is also truly great for pricing and underwriting due to the nature of the data collected, which reflects the risk of the individual and their mobility.

The usage of telematics data will continue to grow as the experience of the carriers will mature and the cost of technology will lower, making it very accessible for many. Data sources will also increase, letting carriers select and create a powerful mix of elements that will help to better assess risks. Despite all this, carriers will have to make further efforts to use telematics data as part of their core processes and take full advantage across all their operations.

By Matteo Carbone, Director, IoT Insurance Observatory, and Massimiliano Kisvarday, Sales Director Telematics, Earnix

Using gaming tactics in apps raises new legal issues

When new innovations emerge, there’s always a temptation to say that we need to rewrite the rulebook for them. Gamification has been no exception.

Gamification refers to the use of elements from gaming, often by a smartphone app, to make ordinary activities like stock trading or rideshares more engaging. It can have powerful influences on our choices, sometimes in controversial ways.

For instance, users of gamified trading apps like Robinhood have suffered huge losses, often from trading too frequently and making outsized bets on meme stocks or other assets that were too risky for them.

By designing their interfaces to make stock trading look more like a game, were these apps steering their users into dangerous trading patterns?

Regulators are examining this issue. A March 2022 consultation paper by the Board of the International Organization of Securities Commissions (IOSCO) questions whether some gamification tactics should be banned.

Gamification’s role in gig work has also raised legal questions. Gig workers seem to act a lot like employees, likely in part because of the gamification tactics that apps use to influence how, where and for how long they work.

But instead of following a growing number of courts and tribunals in Canada and abroad by confirming these workers should be treated as employees, Ontario’s government is proposing that they be brought under a complicated new framework that would give them some, but not necessarily all, of the rights that come with employee status.

Gamification’s challenge to law

As outlined in a report I worked on for the University of Toronto’s Future of Law Lab, legal decision-makers struggle with gamification. It challenges the distinction they’ve traditionally drawn between persuading people with information — which preserves their freedom of choice — and taking that freedom away through coercion or deception.

It’s also possible to capture a degree of control over people’s choices by carefully structuring and timing how you give them information, so as to exploit the mental shortcuts we all take when making decisions. Well-timed push notifications, leaderboards of popular stocks and arbitrary goals assigned to gig workers can all leverage these shortcuts to guide users towards choices that make apps money, but might not serve users’ interests.

Traditional advertising does this too, of course. But unlike a billboard or a TV commercial, a smartphone app follows us around. It can also continuously test prompts and interfaces to identify the ones that do the best job of nudging us in the direction it wants.

Some say existing rules don’t do enough to deal with gamification — that we need new ones to blunt gamification’s influence on our choices. For example, in a virtual hearing for the U.S. House of Representatives Committee on Financial Services, economist Vicki Bogan called for bans on user interface features in trading apps that are “designed to increase more trading volume without regard to consumer priorities or risks.” As noted above, IOSCO is considering similar measures.

Others say existing rules do too much — that they fail to recognize that even if gamification influences our choices, these choices are still technically ours to make. To avoid stifling innovation, apps need their own custom-built set of rules, like Ontario’s proposed gig worker regime.

Leveraging law’s flexibility

Both these lines of argument overlook the flexibility that’s built into law. We can interpret old rules in new ways to reflect the reality that gamification and other digital engagement tactics can have powerful influences over people’s behaviour — and that this influence can be wielded in perverse ways.

Instead of crafting new rules for trading app design, regulators can treat gamification tactics that nudge users into certain investments or trading patterns like tacit investment recommendations. To the extent these tactics work to guide clients into unsuitable investments and trading, regulators can jump into action with their existing rulebooks.

Rather than creating a new category of rights for gig workers, we can recognize that gig workers who are led to act like employees, whether through gamification or other tactics, should be treated as such. Luckily, Ontario’s proposals don’t preclude ongoing efforts to secure these rights through litigation.

Innovation and regulation

Calling for new rules before making full use of the ones we have isn’t just unnecessary. It’s potentially harmful. If we choose to interpret existing rules in rigid or technical ways, so that we have to create new rules for every new innovation, we’ll never catch up. As law falls further behind innovation, those who use technology to implement creative schemes for evading regulation will win out.

Gamification can do a lot of good, when deployed responsibly. It can make investing less intimidating. It can motivate users to learn new languages, new skills or healthier habits.

But apps shouldn’t be able to profit from shaping their users’ choices through gamification and then disclaim responsibility for these choices when regulators come knocking.

Law has tools for encouraging apps to exercise the influence they wield over their users’ choices in a responsible way. We just need to use them.![]()

Doug Sarro, SJD candidate and adjunct professor, Law, University of Toronto